80% of the participants were not satisfied with the current financial system. Despite a crypto bear market, the number of holders hasn’t decreased from its 2022 peak. A Wells notice typically precedes an enforcement action.- Brian Armstrong March 22, 2023ĭata from a recent Coinbase survey showed that 20% of Americans hold digital assets. The founder of the biggest US cryptocurrency exchange also appeared to be surprised as the SEC had received the business in detail before approving it for a 2021 IPO.ġ/ Today Coinbase received a Wells notice from the SEC focused on staking and asset listings. As per Coinbase CEO Biran Armstrong, the company is prepared for the legal battle and would be happy to go to court.īrian also said that a Wells notice is usually followed by an enforcement action. The move came just weeks after the SEC’s strict actions against Kraken exchange and the stablecoin issuer Paxos. Coinbase Gets Wells Notice By SECĪccording to the most recent Coinbase stock news, the company has been served a ‘Wells Notice’ by the Securities & Exchange Commission of the US. However, the prices reversed to make new yearly highs as soon as the US government announced protection for all depositors. The collapse of the Silicon Valley Bank further added fuel to the fire, and BTC slid below $20,000. More recently, Silvergate Capital Corporation has announced its plans to liquidate its banking unit.įollowing the announcement, crypto prices started to tumble. Recently it was announced by the bank that it might not be able to conduct business as usual.įollowing this announcement, many exchanges, including Coinbase Exchange, distanced themselves from the troubled bank. Silvergate was one of the few banks that had partnered with crypto exchanges for fiat payments. The crypto industry is still not recovered from the FTX collapse, and another major institution has collapsed. Coinbase (NASDAQ: COIN) & The Banking Crisis However, the price is tumbling once again as Bitcoin price failed to break above $25,000. Since the start of 2023, Coinbase stock has shown a massive rebound due to a corresponding recovery in BTC price. As of March 20, the stock of the top US Exchange is trading 86% below its 2021 all-time high.Īs Bitcoin peaked at $69,000 in November 2022, Coinbase shares (NASDAQ: COIN) also tumbled. Nonetheless, the following sell-off proved that the company’s stock was overvalued.

The fear of missing out (FOMO) caused many new investors to jump to those insanely high levels. Just within a few days after the launch, Coinbase stock price went from its listing price of $250 to $429. Coinbase IPO was one of the most hyped IPOs of 2021 as it occurred at a time when both traditional and crypto markets were in a bull market.

Coinbase Stock History Was Coinbase IPO Price Overvalued?Īfter establishing itself as one of the major crypto hubs in the world, Coinbase finally listed itself publicly in 2021.

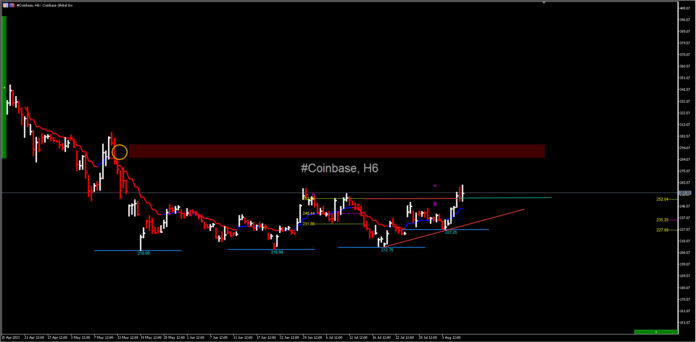

After attempting to recover, the stock crashed again and retested the lowest point as the crypto sell-off intensified. The stock plunged to an all-time low of $40 in May. The subsequent breakout had Coinbase stock price rally to a seven-month high in November 2021 before recording a trend reversal that has continued this year. Granted, it momentarily rose above the range’s upper border to a three-month high in mid-August. At that point, its share price was at a record high of $429.12 as demand for cryptocurrencies was soaring.īetween mid-May and mid-October 2021, it was range-bound between $260.93 and $208.62. Coinbase stock price historyĬoinbase Global, Inc became a publicly-traded company in mid-April 2021. Coinbase currently supports $2 billion in daily trading volume. According to the most recent stats, the exchange has 32.7 million monthly users, which is second to only Binance, with 64.7 million monthly users. Coibase Global is currently the largest digital assets exchange in the US and 2nd largest in the world in terms of the trading volume.

0 kommentar(er)

0 kommentar(er)